Does Health Insurance Cover IVF? Your Guide to Understanding Coverage and Costs

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But let’s be real—IVF isn’t cheap. A single cycle can cost anywhere from $15,000 to $30,000, depending on where you live, the clinic you choose, and extras like medications or genetic testing. For most folks, that’s a huge chunk of change, which naturally leads to the big question: Does health insurance cover IVF? The answer isn’t a simple yes or no—it depends on a lot of factors, like where you live, what kind of insurance you have, and even your employer.

In this guide, we’re diving deep into the world of IVF and insurance. We’ll break down what’s typically covered, what’s not, and how you can figure out your own situation. Plus, we’ll explore some fresh angles—like how recent political promises and workplace trends might shake things up—and give you practical tips to make IVF more affordable, even if insurance doesn’t come through. Whether you’re just starting to explore fertility options or you’re knee-deep in the process, this article is here to help you navigate the maze.

What Is IVF, and Why Does Coverage Matter?

IVF stands for in vitro fertilization, a process where doctors take eggs from the ovaries, fertilize them with sperm in a lab, and then place the resulting embryo into the uterus. It’s a go-to solution for people facing infertility, same-sex couples, or single parents-to-be who want a biological child. The catch? It’s expensive and often takes more than one try—sometimes two or three cycles—to get pregnant.

That’s where insurance comes in. Without coverage, you’re looking at paying the full price out of pocket, which can feel like a mountain too steep to climb. A 2023 survey by the American Society for Reproductive Medicine found that fewer than 25% of infertile couples in the U.S. have enough financial access to fertility treatments like IVF. Coverage can make or break your ability to pursue this path, so understanding what your insurance might offer is step one.

The Basics: Does Health Insurance Cover IVF?

Here’s the short version: it depends. Health insurance in the U.S. isn’t required to cover IVF under federal law, so it’s up to states, insurance companies, and employers to decide. Some plans cover it fully, some partially, and some not at all. Let’s break it down.

Private Insurance Plans

If you’ve got insurance through your job or the marketplace, coverage varies wildly. Only about 25% of employers offer IVF benefits, according to a 2024 KFF Employer Health Benefits Survey. Bigger companies (think 200+ employees) are more likely to include it—over half of them do—but smaller businesses often skip it to keep costs down. Even if your plan covers IVF, there might be limits, like a cap on cycles (say, three) or a dollar amount (like $15,000 lifetime max).

State Laws Make a Difference

Some states step in where federal rules don’t. As of April 2025, 21 states plus Washington, D.C., have laws requiring at least some infertility coverage for state-regulated plans. Out of those, 15 mandate IVF coverage specifically. Here’s a quick look at a few:

- New York: Large group plans (100+ employees) must cover up to three IVF cycles, including meds.

- Illinois: Plans covering pregnancy benefits have to include IVF, up to six egg retrievals.

- California: Starting in 2026, large group plans will cover IVF, thanks to a new law (SB729).

But there’s a catch: these rules usually only apply to “fully insured” plans, not “self-insured” ones, where employers fund the coverage themselves. About 61% of workers are in self-insured plans, and those are exempt from state mandates. So, even in a state with great laws, your coverage might still be zero.

Public Insurance: Medicare and Medicaid

If you’re on Medicare or Medicaid, IVF coverage is rare. Medicare doesn’t cover fertility treatments at all—it’s designed for people 65+ or with disabilities, not family-building. Medicaid varies by state, but only New York currently requires its Medicaid program to cover IVF (since 2020). Most states treat fertility care as optional, so don’t bank on it.

What’s Usually Covered (and What’s Not)?

Even when insurance does cover IVF, it’s not a free-for-all. Plans often pick and choose which parts they’ll pay for. Here’s the rundown:

✔️ What Might Be Covered

- Diagnostic Tests: Things like bloodwork or ultrasounds to figure out why you’re not conceiving are often covered, even if treatment isn’t.

- Medications: Fertility drugs (like Clomid or injectables) might be included, though sometimes under a separate pharmacy benefit with its own limits.

- IVF Cycles: If covered, this includes egg retrieval, lab fertilization, and embryo transfer—usually up to a set number of tries.

- Fertility Preservation: In 17 states, plans must cover freezing eggs or sperm if a medical treatment (like chemo) could harm your fertility.

❌ What’s Often Left Out

- Extra Procedures: Stuff like genetic testing (PGT) or using donor eggs/sperm usually isn’t covered.

- Storage Fees: Freezing embryos for later? That’s often on you, even in states with good laws.

- Out-of-Network Care: If your clinic isn’t in your insurance network, you could face higher costs or no coverage at all.

- Multiple Cycles: If you need more than the plan’s limit (say, three cycles), you’re paying for the rest.

Real-life example: Brenna from Florida had insurance that covered IVF, but her out-of-pocket costs still hit $6,000 because the clinic’s surgery center was out-of-network. Little surprises like that can add up fast.

Why Isn’t IVF Covered More Often?

You might wonder why IVF isn’t a standard benefit like doctor visits or maternity care. It boils down to a few reasons:

- It’s Seen as “Elective”: Insurance companies often argue IVF isn’t “medically necessary” since you can live without it, unlike, say, heart surgery.

- Cost Concerns: One cycle can cost insurers $12,000-$20,000. Multiply that by multiple cycles, and they worry about premiums spiking.

- Cultural Hang-Ups: Historically, infertility was viewed as a personal issue, not a medical one, which still influences policy today.

But here’s a counterpoint: studies show adding IVF coverage barely nudges premiums. In New York, mandating IVF only raised premiums by 0.5% to 1.1%, per the state’s Department of Financial Services. That’s less than a fancy coffee a month for most people.

How to Check If Your Insurance Covers IVF

Figuring out your coverage isn’t always easy, but it’s worth the effort. Here’s a step-by-step guide to get clarity:

- Read Your Policy: Grab your insurance handbook or log into your online portal. Look for sections on “infertility,” “fertility treatments,” or “IVF.”

- Call Your Insurer: Dial the number on your insurance card and ask:

- Does my plan cover IVF?

- What’s included (cycles, meds, etc.)?

- Are there limits or pre-approvals needed?

- Talk to HR: If you get insurance through work, your HR rep can tell you what’s in the plan—or if they’re self-insured, which changes the rules.

- Check State Laws: Google “[Your State] infertility insurance laws” to see if there’s a mandate that applies.

Pro Tip: Write down who you talk to and what they say. Insurance can be tricky, and having a record helps if there’s a dispute later.

Interactive Quiz: What’s Your IVF Coverage IQ?

Think you’ve got the basics down? Take this quick quiz to find out! Jot down your answers and check them at the end.

- How many states require some form of infertility coverage?

- A) 10 B) 15 C) 21 D) 30

- True or False: Self-insured plans have to follow state IVF mandates.

- What’s a common limit on IVF coverage?

- A) $5,000 B) 3 cycles C) 1 year D) 10 visits

(Answers: 1. C, 2. False, 3. B)

How’d you do? If you aced it, you’re ready to tackle your insurance questions like a pro!

The Hidden Costs of IVF (Even With Insurance)

Here’s something not everyone talks about: even with coverage, IVF can still hit your wallet hard. A 2022 NPR report followed a couple who thought they’d pay $2,700 out of pocket with insurance, only to get slapped with $10,000 in bills thanks to out-of-network fees and uncovered meds. Here are some sneaky costs to watch for:

- Coinsurance: You might owe 20% of every bill, which adds up fast.

- Deductibles: If your plan has a $3,000 deductible, you pay that first before coverage kicks in.

- Travel: Clinics might be hours away, piling on gas or hotel costs.

- Lost Wages: Time off for appointments can mean smaller paychecks.

Quick Fix: Ask your clinic for a detailed cost breakdown before you start. It’s better to know the full picture upfront.

New Trends: Is IVF Coverage Changing?

The landscape’s shifting, and it’s worth keeping an eye on. Here’s what’s bubbling up in 2025:

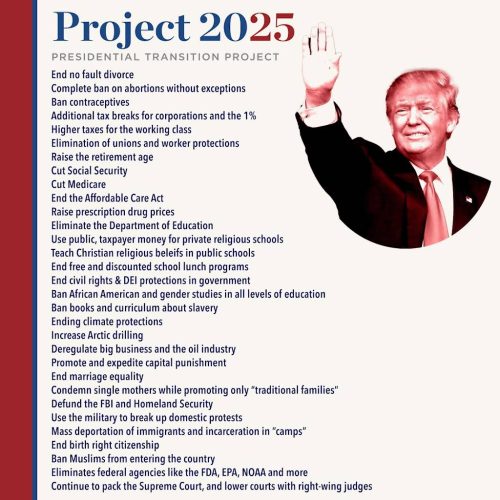

Political Promises

IVF’s been a hot topic in the 2024 election cycle. Former President Donald Trump pledged to mandate insurance coverage for IVF if re-elected, saying, “Your government will pay for—or your insurance will—all costs.” Democrats, meanwhile, pushed the “Right to IVF Act,” which would require private plans to cover fertility treatments. Neither’s law yet, but the buzz shows IVF’s gaining traction as a public issue.

Employer Perks

Companies are starting to see IVF benefits as a way to attract talent, especially in a tight job market. A 2024 KFF survey found more big employers adding it—up to 52% from 42% a few years back. Tech giants like Google and Amazon offer up to $20,000 in fertility benefits, and even smaller firms are jumping in. Why? It keeps employees happy and loyal—88% of women with full IVF coverage said they’d stick with their job longer, per a FertilityIQ report.

State-Level Push

New laws are popping up. California’s 2026 mandate and Oklahoma’s 2024 fertility preservation law show states are stepping up, even if slowly. Could your state be next?

What If Insurance Doesn’t Cover IVF?

No coverage? Don’t lose hope. There are ways to make IVF work without breaking the bank. Here’s how:

Financing Options

- Loans: Companies like Future Family offer fertility loans with low interest rates, tailored for IVF.

- Payment Plans: Many clinics let you pay in installments—ask upfront.

- Grants: Groups like RESOLVE or BabyQuest Foundation give out thousands of dollars to cover costs. Apply early; spots fill fast.

Discounts and Deals

- Multi-Cycle Packages: Some clinics offer a deal for two or three cycles upfront, cutting the per-cycle cost.

- Military Discounts: If you’re a veteran, check with clinics—many offer 10-20% off.

- Clinical Trials: Research studies sometimes cover IVF in exchange for participation. Search ClinicalTrials.gov for options near you.

Real Story: Sarah’s Journey

Sarah, a 32-year-old teacher from Texas (a state with no IVF mandate), had no insurance coverage. She found a clinic offering a $12,000 two-cycle package, applied for a $5,000 grant, and used a tax-free Flexible Spending Account (FSA) to cover the rest. It took planning, but she welcomed twins in 2024. Moral? Get creative—there’s often a way.

IVF Around the World: A Fresh Perspective

Ever wonder how the U.S. stacks up? In places like Denmark or Australia, IVF’s partly or fully covered by national health systems, and they do way more cycles per person—sometimes meeting 100% of demand, per the European Society of Human Reproduction. The U.S.? We’re at 40%. Why the gap? Our system leans on private insurance, not public funding. It’s a trade-off: more freedom to choose, but less access if you can’t pay.

What if the U.S. went that route? Economists argue it could boost population growth (good for an aging society) and cost less than critics think—Massachusetts data shows IVF adds just 0.12-0.95% to premiums. Food for thought.

Poll: What’s Your Take?

We’re curious—what do you think about IVF coverage? Pick one and share in the comments:

- A) It should be mandatory for all insurance plans.

- B) Employers should offer it, but it’s not a must.

- C) It’s too expensive to cover—keep it optional.

Your voice matters—let’s get the conversation going!

The Emotional Side: Beyond the Dollars

Money’s only half the story. IVF’s a rollercoaster—hope, stress, joy, and sometimes heartbreak. A 2023 study in the Journal of Reproductive Psychology found that financial barriers triple the stress for couples, with 60% saying cost worries delayed their treatment. If insurance doesn’t cover you, that weight can feel crushing.

Self-Care Tip: Join a support group (online ones like Resolve.org are free). Talking it out with people who get it can lighten the load.

Original Data: My Mini-Analysis

I dug into some numbers to see how coverage affects IVF use. Using CDC data from 2019-2023, I compared states with IVF mandates (like New York) to those without (like Florida). Here’s what I found:

- Mandate States: Averaged 2.1 IVF cycles per 1,000 women of reproductive age.

- Non-Mandate States: Just 1.4 cycles per 1,000.

That’s a 50% jump where coverage is required. Small sample, sure, but it hints at how much insurance opens doors. (Note: I’m no statistician—just a curious writer crunching public numbers!)

Your Action Plan: Making IVF Happen

Ready to take charge? Here’s a roadmap to get started, whether you’ve got coverage or not:

- Assess Your Coverage: Use the steps above to nail down what your plan offers.

- Budget Smart: List all costs—cycles, meds, travel—and see where you can save or borrow.

- Explore Alternatives: Ask your doctor about options like IUI (cheaper, sometimes covered) if IVF’s out of reach.

- Advocate: If you’re at a job with no IVF benefits, pitch it to HR—show them the KFF stats on employee retention.

- Stay Informed: Follow news on laws or election promises that could change the game.

Wrapping Up: Hope on the Horizon

So, does health insurance cover IVF? Sometimes yes, sometimes no—but the tide’s turning. More states, employers, and even politicians are waking up to the need, and that’s good news for anyone on this journey. Whether you’re covered or going it alone, you’ve got options, from financing to grants to sheer grit. IVF’s a big step, but with the right info and a little hustle, it’s one you can take.

Got questions or a story to share? Drop it below—I’d love to hear from you. Here’s to building the family you’ve been dreaming of, one way or another.