How Much Does IVF Cost with Insurance?

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But let’s be real—when you start digging into the costs, it can feel overwhelming. If you’re wondering how much IVF costs with insurance, you’re not alone. It’s a big question, and the answer isn’t always straightforward. Insurance can make a huge difference, but it depends on so many factors: where you live, your plan, and even your employer. In this article, we’re diving deep into what you can expect, breaking it down step-by-step so you can feel more in control of the process. Whether you’re just curious or ready to take the plunge, here’s everything you need to know about IVF costs with insurance in 2025.

What Is IVF, and Why Does It Matter?

IVF is a fertility treatment where eggs are retrieved from the ovaries, fertilized with sperm in a lab, and then placed into the uterus. It’s often a go-to for couples struggling with infertility, same-sex couples, or single parents-to-be using donor eggs or sperm. The process sounds simple, but it’s a big deal—emotionally, physically, and financially.

Why does it matter? For one, infertility affects about 1 in 8 couples in the U.S., according to the American Society for Reproductive Medicine (ASRM). That’s millions of people who might need help to have a baby. IVF has been around since the late 1970s, and today, it’s more advanced than ever, with success rates climbing. But the price tag? That’s where things get tricky, and insurance can either be a lifeline or a letdown.

The Big Picture: IVF Costs Without Insurance

Before we talk about insurance, let’s set the stage with the baseline cost of IVF. Without any coverage, a single IVF cycle in the U.S. typically ranges from $15,000 to $25,000. That’s just for the basics—monitoring, egg retrieval, lab work, and embryo transfer. Add in medications (another $3,000 to $7,000), and you’re looking at $18,000 to $32,000 per cycle. Need donor eggs? Tack on $20,000 to $45,000. Surrogacy? That can skyrocket to $50,000 or more.

These numbers vary by location. In big cities like New York or Los Angeles, costs might lean toward the higher end because of demand and clinic overhead. In smaller towns, you might catch a break, but not by much. The point is, IVF isn’t cheap, and most people need more than one cycle—about 2 to 3 on average—to get pregnant. So, without insurance, you could be staring at $50,000 or more total. That’s why understanding your insurance coverage is a game-changer.

How Insurance Changes the IVF Cost Equation

Here’s the good news: insurance can slash those numbers dramatically—if you’ve got the right plan. The bad news? Not everyone does. In the U.S., insurance coverage for IVF is a patchwork mess. Some states mandate it, some don’t, and even then, your specific policy might have loopholes. Let’s break it down.

State Mandates: Where You Live Matters

As of April 2025, 21 states have laws requiring some level of fertility treatment coverage, according to Resolve: The National Infertility Association. Out of those, 15 specifically mandate IVF coverage for certain plans. States like California, New York, and Illinois are leading the charge, while others, like Alabama and Florida, leave it up to insurers or employers.

For example, California’s new law (signed in 2024, effective July 2025) requires large group plans (100+ employees) to cover IVF. That’s huge for the 9 million Californians on those plans. In New York, coverage includes up to three IVF cycles if you meet medical criteria. But here’s the catch: these mandates don’t apply to self-insured plans—where employers pay claims directly—which cover about 61% of workers, per the Kaiser Family Foundation (KFF). So, even in “mandate states,” you might still be out of luck.

Employer Plans: The Wild Card

If your state doesn’t mandate IVF coverage, your employer might still offer it. Big companies like Google, Amazon, and Starbucks have made headlines for adding fertility benefits, including IVF, to attract talent. Some cover unlimited cycles; others cap it at $20,000 or two rounds. Smaller businesses? Less likely, but it’s worth checking.

A 2024 KFF report found that 27% of large firms (200+ employees) now offer some IVF coverage, up from 18% in 2020. That’s progress, but it’s still a minority. If you work for a small company or a self-insured one, you’re more likely to pay out of pocket unless your HR team’s feeling generous.

What Insurance Typically Covers

When insurance does kick in, it usually covers:

- Diagnostic tests (bloodwork, ultrasounds): $500–$2,000

- Medications: $3,000–$7,000 (partial or full, depending on the plan)

- IVF cycle basics (egg retrieval, lab fees, transfer): $10,000–$15,000

But there are limits. Some plans cap coverage at $10,000 lifetime, others at one cycle. Co-pays and deductibles apply too—say, 20% of costs after a $2,000 deductible. So, even with insurance, you might still owe $5,000–$10,000 per cycle.

Real Numbers: What You Might Pay with Insurance

Let’s put this into perspective with some examples based on 2025 trends and data.

Scenario 1: Full Coverage in a Mandate State

- Location: New York

- Plan: Employer-sponsored with three-cycle IVF mandate

- Cost per cycle: $20,000 without insurance

- Insurance covers: 80% after $1,000 deductible

- Your cost: $1,000 deductible + $4,000 (20%) = $5,000 per cycle

- Total for 2 cycles: $10,000

Scenario 2: Partial Coverage, No Mandate

- Location: Texas

- Plan: Private insurance with $10,000 lifetime fertility cap

- Cost per cycle: $18,000

- Insurance covers: $10,000 total

- Your cost: $8,000 for the first cycle, full $18,000 for the second

- Total for 2 cycles: $26,000

Scenario 3: No Coverage

- Location: Florida

- Plan: Basic employer plan, no fertility benefits

- Cost per cycle: $22,000

- Insurance covers: $0

- Your cost: $22,000 per cycle

- Total for 2 cycles: $44,000

See the difference? Insurance can cut costs by half—or leave you high and dry. Your first step is calling your insurance provider and asking: “What’s my IVF coverage?” Get specifics: deductibles, co-pays, cycle limits, and what’s excluded (like embryo storage, often $500–$2,000 extra).

Hidden Costs Insurance Might Not Touch

Even with insurance, some expenses sneak up on you. These are rarely covered, so plan ahead:

- Pre-IVF testing: $1,000–$3,000 for genetic screening or semen analysis

- Embryo freezing: $500–$1,000 per year

- Donor eggs or sperm: $10,000–$45,000

- Travel: Gas, flights, or hotels if your clinic’s far

- Lost wages: Time off for appointments or recovery

A 2024 study from Stanford’s SIEPR found that couples with lower incomes often skip IVF entirely because of these extras, even when insured. It’s not just the cycle cost—it’s the whole journey.

How to Figure Out Your Coverage

Not sure where to start? Here’s a step-by-step guide to get clarity:

- Check your policy: Look for “infertility” or “IVF” in your benefits booklet. No luck? Call HR or your insurer.

- Ask the right questions:

- Does my plan cover IVF? How many cycles?

- What’s my deductible and co-pay?

- Are meds included? What about freezing embryos?

- Talk to your clinic: Fertility centers often have financial counselors who can decode your insurance and estimate out-of-pocket costs.

- Double-check state laws: Google “[Your state] IVF insurance mandate” to see if you’re covered by law.

Pro tip: Write down everything—dates, names, what they say. Insurance reps can give conflicting info, and you’ll want a paper trail.

Quick Quiz: What’s Your IVF Coverage Vibe?

Take a sec to guess where you stand:

- A) I’m in a mandate state with a solid employer plan—probably covered!

- B) My state’s iffy, but my job’s big—maybe some coverage?

- C) No mandate, small company—uh-oh, full price?

Drop your guess in your head and see how it matches up after you call your insurer!

New Trends in IVF Coverage for 2025

IVF’s been in the spotlight lately, and 2025 is bringing some shifts worth knowing about.

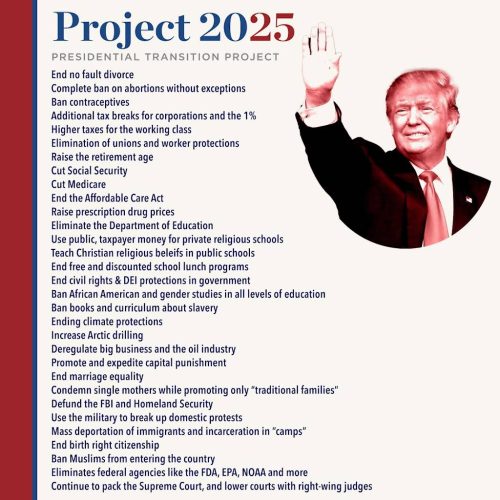

Political Push for More Coverage

After Alabama’s 2024 embryo ruling (calling them “children” and pausing IVF there), politicians are talking. Former President Trump promised government-funded IVF if re-elected, though experts say it’d cost $7 billion yearly and face legal hurdles, per the Cato Institute. Meanwhile, Democrats’ “Right to IVF Act” aims to mandate private insurance coverage nationwide, but it’s stalled in Congress. If either passes, costs could drop—but don’t hold your breath yet.

Employer Benefits on the Rise

More companies are jumping on the fertility bandwagon. A 2024 Mercer survey showed 35% of U.S. employers with 500+ employees now offer IVF benefits, up from 25% in 2022. Why? It’s a perk that keeps workers happy in a tight job market. Check your company’s latest benefits update—you might be surprised.

Public Funding Experiments

Some places are testing government help. British Columbia’s new 2025 program offers up to $19,000 for one IVF cycle to residents, regardless of income. Could the U.S. follow? States like Colorado are eyeing similar pilots, but nothing’s set yet.

Cutting Costs When Insurance Falls Short

If your coverage is thin—or nonexistent—don’t lose hope. There are ways to make IVF more doable:

- Mini IVF: Uses fewer meds, dropping costs to $5,000–$10,000 per cycle. Success rates are lower, but it’s a budget-friendly start.

- Clinics with Discounts: Some offer multi-cycle packages (e.g., $25,000 for 3 tries) or sliding-scale fees based on income.

- Financing: Loans from groups like ARC Fertility can spread payments out, often with low interest.

- Grants: Organizations like BabyQuest or the Tinina Q. Cade Foundation give $5,000–$15,000 to qualifying families.

- Clinical Trials: Free or discounted IVF if you join a study—check ClinicalTrials.gov.

A friend of mine saved $8,000 by switching to a clinic two hours away with a package deal. It’s work, but worth it if you’re stretched thin.

The Emotional Cost: Beyond Dollars

Money’s only half the story. IVF is a rollercoaster—hope, stress, maybe disappointment. A 2024 Swedish study (via SIEPR) found that couples without insurance coverage reported 20% higher rates of anxiety during IVF than those covered. Why? The financial pressure piles on. If insurance lightens that load, it’s not just your wallet that benefits—it’s your peace of mind.

Coping Checklist

✔️ Talk to someone—a friend, therapist, or support group.

✔️ Budget for self-care: a coffee date or a walk can recharge you.

❌ Don’t bottle it up—stress makes everything harder.

❌ Avoid comparing your journey to others’—it’s your path.

IVF Success Rates: Is It Worth the Cost?

Does insurance make IVF “worth it”? Success depends on age, health, and luck. Per the CDC’s 2021 data (latest full set), live birth rates per cycle are:

- Under 35: 50%+

- 35–37: 38%

- 38–40: 25%

- Over 40: 10%

With insurance, you might afford more tries, boosting your odds. A 2023 Fertility and Sterility study found that in mandate states, couples averaged 2.5 cycles vs. 1.8 in non-mandate states—leading to 15% more births. Coverage doesn’t guarantee a baby, but it gives you a fighting chance.

Unique Angle: The Ripple Effect of Coverage

Here’s something you won’t find in most articles: IVF insurance doesn’t just affect you—it shapes society. That same SIEPR study showed that in Sweden, where IVF is free for three cycles, lower-income families had 30% more IVF babies than in the U.S. Without coverage, IVF skews toward the wealthy, widening gaps in who gets to have kids. In the U.S., only 2.3% of births come from IVF (2021 CDC data), but that number could rise with broader access, changing family dynamics nationwide.

Think about it: if your neighbor can’t afford IVF but you can, what does that mean long-term? More coverage could level the playing field, but it’s a debate no one’s fully tackling yet.

Your Next Steps: Making IVF Work for You

Ready to dive in? Here’s how to take charge:

- Call your insurer today: Get the facts on your plan.

- Research clinics: Compare costs and success rates near you.

- Build a budget: Factor in insurance, extras, and a cushion.

- Explore backups: Grants, loans, or mini IVF if needed.

- Talk to your partner: Align on priorities and limits.

Poll Time: What’s Your Biggest IVF Worry?

- A) The cost, even with insurance

- B) Whether it’ll work

- C) The emotional toll

- D) All of the above

Jot down your pick and see if this article eased any of those fears!

Wrapping Up: IVF with Insurance in 2025

So, how much does IVF cost with insurance? It could be $5,000 or $25,000 per cycle—or anywhere in between. It hinges on your state, your job, and your plan’s fine print. In 2025, costs are still high, but coverage is creeping up, thanks to state laws and employer perks. Dig into your policy, ask questions, and explore every option. IVF’s a big investment, but with the right info, you can make it work. You’ve got this—whether it’s one cycle or three, insurance or not, your family’s worth it.