Is IVF Covered by Insurance? Your Ultimate Guide to Understanding Coverage

Starting a family is a dream for many, but for some, the journey involves extra steps—like in vitro fertilization (IVF). If you’re considering IVF, one of the first questions that might pop into your head is: Will my insurance help pay for this? It’s a big deal because IVF can cost thousands of dollars per cycle, and most people don’t have that kind of cash just lying around. The good news? Some insurance plans do cover IVF, at least partially. The bad news? It’s not always straightforward, and coverage varies wildly depending on where you live, what plan you have, and even your employer.

In this guide, we’re diving deep into the world of IVF and insurance. We’ll break down what’s typically covered, why it’s so tricky to figure out, and how you can get the most out of your plan—or find other ways to make it work if insurance falls short. Plus, we’ll sprinkle in some fresh insights you won’t find everywhere else, like how recent laws and trends are shaking things up in 2025. Let’s get started!

What Is IVF, Anyway?

IVF stands for in vitro fertilization, a process where doctors take eggs from a woman’s ovaries, fertilize them with sperm in a lab, and then place the resulting embryos back into the uterus. It’s a lifeline for people dealing with infertility—whether it’s due to blocked fallopian tubes, low sperm count, or other challenges. A single cycle can take weeks and involves medications, monitoring, and procedures like egg retrieval.

But here’s the catch: it’s expensive. In the U.S., one round of IVF can cost between $12,000 and $20,000, not counting extras like medications (another $3,000-$5,000) or freezing embryos for later. That’s why insurance coverage matters so much—it can mean the difference between moving forward with treatment or putting your dreams on hold.

Does Insurance Cover IVF? The Short Answer

Sometimes, yes—but it depends. In the U.S., there’s no national rule saying insurance has to cover IVF. Instead, it’s a patchwork of state laws, employer decisions, and individual plans. As of April 2025, about 22 states plus Washington, D.C., have laws requiring some level of infertility coverage, but only some include IVF specifically. Even then, the details differ a lot.

For example, California just passed a law in late 2024 (effective July 2025) mandating large group plans to cover IVF, including for LGBTQ+ families. Meanwhile, states like Alabama don’t require it at all. If you’re on a private plan through your job, your employer might choose to offer IVF coverage—or not. And if you’re on Medicaid? Coverage is rare, though New York is an exception with limited fertility drug support.

So, the short answer is: check your plan, your state, and your situation. But don’t worry—we’re about to unpack all of this step by step.

Why IVF Coverage Is Such a Mixed Bag

Insurance companies don’t always see IVF as a “must-cover” treatment. Historically, some viewed it as optional, like cosmetic surgery, rather than a medical necessity. Plus, it’s costly, and success isn’t guaranteed—about 50% of cycles for women under 35 result in a live birth, and that drops with age. Insurers weigh these risks and often pass the cost back to you.

But things are shifting. Public demand is growing, and more people see infertility as a health issue deserving support. Laws are catching up, too—states like New York and Illinois have strong mandates, while others are playing catch-up. Still, gaps remain, especially for smaller businesses or self-insured plans, which don’t have to follow state rules.

The Role of Your Employer

If you get insurance through work, your employer has a big say. Larger companies (think 5,000+ employees) are more likely to cover IVF—over half do, according to a 2024 KFF survey. Smaller ones? Only about 25% offer it. Why? Big companies can spread the cost across more people, and they often use benefits like this to attract talent in a competitive job market.

Take Haley, a 29-year-old IT specialist from California. She switched jobs in 2024 partly because her new employer offered IVF coverage. “I wasn’t even pregnant yet, but I knew we might need help,” she says. “It was a game-changer.” Stories like hers show how employer plans can tip the scales.

State Laws: Where You Live Matters

Your state can make or break your coverage. Here’s a quick rundown of how it works:

- Mandate States: Places like Massachusetts and New Jersey require insurers to cover IVF, often with limits (e.g., three cycles). These states tend to have higher IVF use because costs are lower.

- Partial Mandate States: California and New York cover some infertility treatments but have exceptions—like no IVF for small group plans in some cases.

- No Mandate States: In states like Florida or Texas, it’s up to your insurer or employer. You’re more likely to pay out of pocket here.

Check your state’s laws—RESOLVE, a national infertility group, has a handy map updated for 2025. It’s a starting point to see what rules apply to you.

What Parts of IVF Might Be Covered?

Even if your insurance covers IVF, it’s rarely the whole package. Plans break it down into pieces, and you might get some covered but not others. Here’s what’s typically in play:

- Diagnostic Tests: Blood work, ultrasounds, and semen analysis are often covered, even in plans without full IVF support. These can cost $500-$2,000 without insurance.

- Medications: Fertility drugs like Clomid or injectables might be partially covered, but it varies. A full cycle’s meds can hit $5,000.

- Procedures: Egg retrieval, lab fertilization, and embryo transfer are the big-ticket items. Full coverage here is rare outside mandate states.

- Extras: Freezing embryos or genetic testing (PGT) usually isn’t covered, adding $1,000-$5,000 per cycle.

A Real-Life Example

Meet Sarah, a 34-year-old teacher from Illinois. Her insurance covered diagnostics and meds but capped IVF at one cycle. “We got $10,000 covered, but the rest—another $8,000—was on us,” she says. “It helped, but we still had to save up.” Her story shows how partial coverage can ease the burden but rarely eliminates it.

How to Find Out If Your Plan Covers IVF

Figuring out your coverage isn’t always easy—insurance documents can feel like a foreign language. But it’s worth the effort. Here’s a step-by-step guide to get clarity:

- Read Your Policy: Look for terms like “infertility treatment” or “assisted reproductive technology” in your benefits booklet. Ctrl+F is your friend!

- Call Your Insurer: Ask specific questions: “Does my plan cover IVF? What about meds or freezing?” Record who you talk to and what they say.

- Talk to HR: If you’re on an employer plan, your HR team can explain what’s included—or even push for better benefits.

- Check with Your Clinic: Fertility clinics often have financial counselors who can decode your coverage and spot gaps.

Quick Quiz: Test Your IVF Coverage Smarts

Let’s make this fun! Answer these quick questions to see how ready you are:

- Does your state require IVF coverage? (Yes/No/Don’t Know)

- Have you checked your insurance policy for infertility benefits? (Yes/No)

- Do you know if your plan covers medications? (Yes/No/Don’t Know)

If you answered “No” or “Don’t Know” to any, it’s time to dig in. Knowledge is power here!

What If Your Insurance Doesn’t Cover IVF?

No coverage? You’re not out of options. People get creative, and there are paths to make IVF more affordable. Here are some ideas:

Look Beyond Your Current Plan

- Switch Jobs: Some companies—like Starbucks or tech giants—offer IVF benefits even for part-time workers. It’s a long shot, but it’s worked for some.

- Buy a New Plan: Open enrollment (usually November) lets you pick a plan with better infertility coverage. Compare options on Healthcare.gov.

- Move to a Mandate State: Extreme, yes, but people have relocated for cheaper IVF access. Think Massachusetts or Connecticut.

Tap Into Financial Help

- Grants: Groups like BabyQuest or the Tinina Q. Cade Foundation offer IVF grants—sometimes up to $10,000. Apply early; spots fill fast.

- Loans: Medical loans from banks or clinics can spread costs over time. Look for low-interest options.

- Clinic Discounts: Some offer “shared risk” programs—if IVF fails after a set number of cycles, you get a refund. Monash IVF, for example, has plans like this.

A Hidden Gem: Fertility Preservation Laws

Here’s something new: as of 2025, 12 states require coverage for fertility preservation (freezing eggs or sperm) if you’re facing medical treatments like chemo that could harm fertility. It’s not full IVF, but it’s a start—and often overlooked. Check if your state’s on the list (New York, Delaware, and California are).

The Cost Breakdown: What You’re Really Paying For

To understand coverage, you need to know what IVF costs. Here’s a simple table based on 2025 averages in the U.S.:

| IVF Component | Cost Without Insurance | Often Covered? |

|---|---|---|

| Initial Consultation | $200-$500 | Yes |

| Diagnostic Tests | $500-$2,000 | Yes |

| Medications | $3,000-$5,000 | Sometimes |

| Egg Retrieval | $5,000-$7,000 | Rarely |

| Lab Fertilization | $2,000-$4,000 | Rarely |

| Embryo Transfer | $1,500-$3,000 | Rarely |

| Embryo Freezing (1 year) | $1,000-$2,000 | No |

| Genetic Testing (PGT) | $2,000-$5,000 | No |

Total without coverage? Easily $15,000-$25,000 per cycle. With partial insurance, you might cut that in half—but full coverage is the golden ticket.

New Trends Shaping IVF Coverage in 2025

The IVF landscape is changing fast. Here’s what’s hot right now:

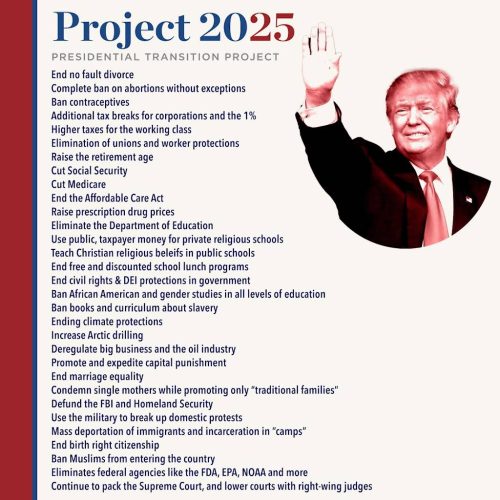

Political Push and Pull

IVF hit the headlines in 2024 when Alabama’s Supreme Court ruled embryos are “children,” pausing treatments there. It sparked a national debate—some politicians now push for federal IVF coverage, while others resist. Former President Trump even pledged in 2024 to mandate IVF coverage if re-elected, though experts say it’d cost billions and face legal hurdles. Keep an eye on this; it could flip the script.

Employer Benefits on the Rise

Companies are stepping up. A 2024 KFF report found more employers adding IVF to compete for workers—think Google or Amazon. It’s not universal, but it’s a trend worth watching, especially if you’re job-hunting.

State Laws Expanding

California’s 2025 law is just one example. States like Virginia and Colorado are debating similar mandates. If you’re in a non-mandate state, advocacy groups like RESOLVE are pushing for change—your voice could help.

Unique Angle: The Emotional Cost of No Coverage

Most articles focus on dollars, but let’s talk feelings. Infertility is tough enough—add financial stress, and it’s a double whammy. A 2023 study in Fertility and Sterility found couples without IVF coverage reported 30% higher rates of anxiety and depression. “It’s not just about money,” says Dr. Jane Kim, a fertility specialist. “It’s the fear of being priced out of parenthood.”

Take Lisa, a 37-year-old from Texas with no coverage. “We drained our savings for one cycle,” she says. “When it failed, I felt like we’d lost more than money—it was hope.” Clinics are starting to offer mental health support alongside financial counseling, a trend that’s growing in 2025.

IVF Coverage Around the World: A Comparison

The U.S. lags behind some countries. In Denmark, you get three free IVF cycles if you’re under 40—success rates there are sky-high because access is easy. Israel covers IVF until you have two kids, no age limit. Compare that to the U.S., where only 25% of large employers cover it, and you see the gap. Could this inspire change here? Maybe—it’s a model advocates point to.

Your Action Plan: Making IVF Work for You

Ready to take charge? Here’s how to navigate this:

If You Have Coverage

- Maximize It: Use every covered test or med before paying out of pocket.

- Ask About Limits: Some plans cap cycles or dollars—know yours.

- Document Everything: Keep records for appeals if claims get denied.

If You Don’t Have Coverage

- Negotiate: Clinics sometimes discount for cash payers—ask!

- Crowdfund: Friends and family might chip in via GoFundMe.

- Plan Ahead: Save monthly in a high-yield account for future cycles.

Poll: What’s Your Next Step?

What’s your biggest IVF hurdle? Vote below to see what others say—it’s anonymous!

- A) Finding out if I’m covered

- B) Affording it without insurance

- C) Deciding if IVF’s right for me

- D) Other (share in your head!)

Results show up next week—stay tuned!

The Future of IVF Coverage: What’s Next?

Looking ahead, IVF coverage could grow. Public support is climbing—70% of Americans back insurance mandates, per a 2024 Pew poll. Plus, as treatments get cheaper (think mini-IVF, which cuts costs by 30%), insurers might soften up. But it’s not a done deal—cost concerns and political divides could slow things down.

One wild card? Telehealth fertility consults, up 40% since 2023. They’re often covered when in-person visits aren’t, a loophole worth exploring. “It’s a game-changer for rural patients,” says Dr. Kim. Watch this space.

Wrapping Up: You’ve Got This

IVF and insurance can feel like a maze, but you’re not alone. Whether your plan covers it, partially helps, or leaves you on your own, there’s a way forward. Dig into your policy, lean on your clinic, and explore every option—grants, loans, even a job switch. The journey’s tough, but every step gets you closer to your goal.

Got a story or tip about IVF coverage? Drop it in the comments—I’d love to hear how you’re making it work. And if this helped, share it with someone who needs it. Here’s to building your family, however it happens!